Market Surveillance in Germany

Market Surveillance ensures proper conduct of trading

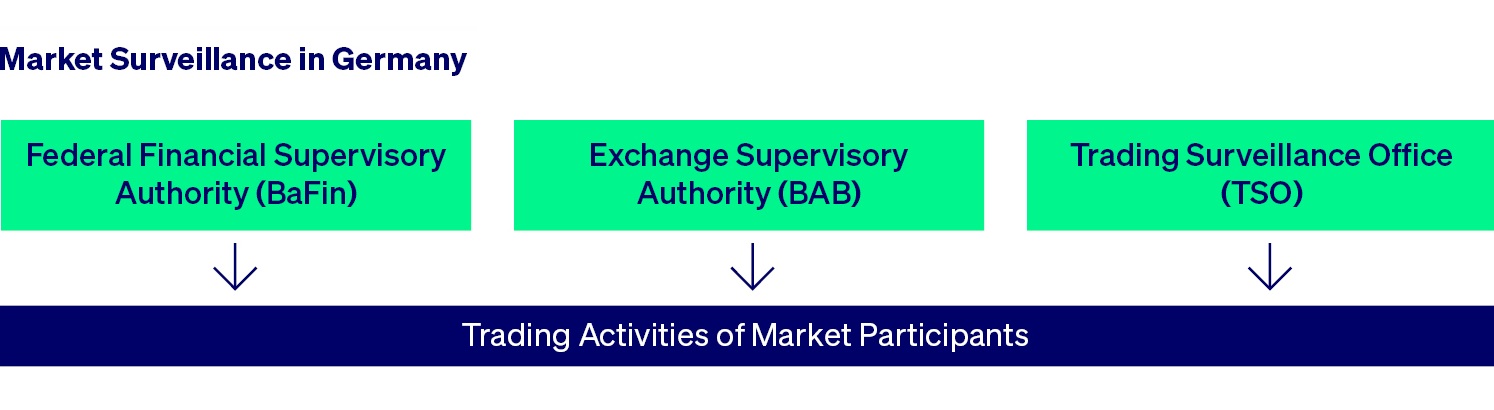

A functioning market surveillance is indispensable for the proper conduct of exchange trading including the correct determination of prices in accordance with the rules. In Germany, several authorities work closely together here.

Their aim is to ensure national and international standards are upheld.

Overview of content

- The TSO monitors trading

- Exchange Supervisory Authority

- Investigations and operations of the TSO

- BaFin

The TSO monitors trading

According to § 7 of the German Exchange Act (BörsG), the Trading Surveillance Office (TSO) is an independent stock exchange body and part of market surveillance. It monitors exchange trading and the settlement of exchange transactions on the cash market (Frankfurt Stock Exchange) and the derivatives market (Eurex Deutschland).