Market Surveillance in Germany

Market Surveillance ensures proper conduct of trading

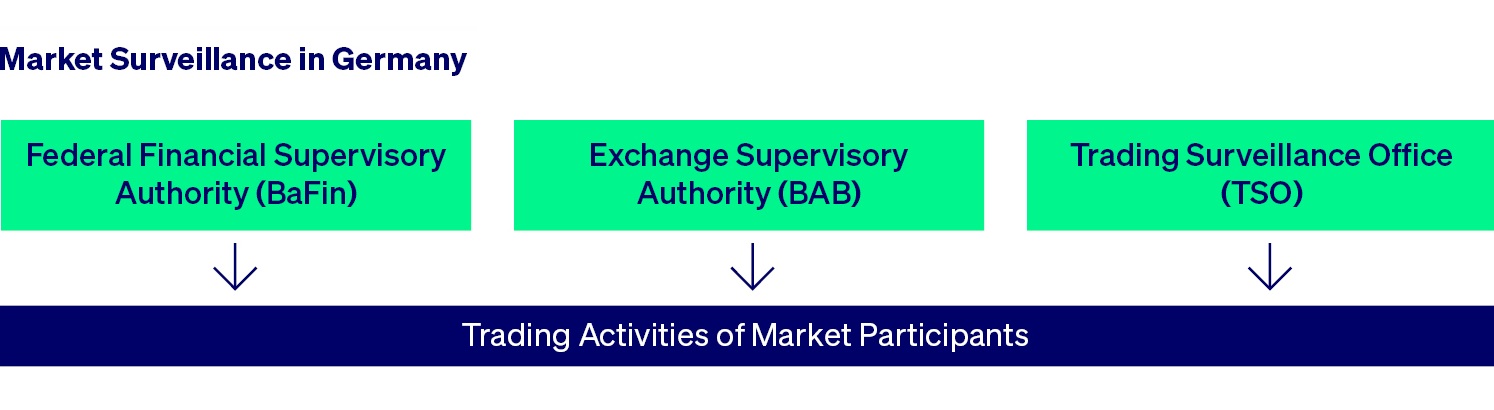

A functioning market surveillance is indispensable for the proper conduct of exchange trading including the correct determination of prices in accordance with the rules. In Germany, several authorities work closely together here.

Their aim is to ensure national and international standards are upheld.

Overview of content

BaFin

The Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin, German Federal Financial Supervisory Authority) , is an independent institution under public law. It conducts investigations in the field of securities supervision, amongst other things, in cases of insider trading and market manipulation. It also examines possible infringements of publication duties and uncovers infringements of other regulations of the Securities Trading Act.