Designated Sponsors are market participants who post binding buy and sell offers for the trading of less liquid securities. There can be one or several Designated Sponsors per security. The trading participant submits an application to be admitted as a Designated Sponsor on Deutsche Börse Xetra to the Frankfurter Wertpapierbörse (FWB®, the Frankfurt Stock Exchange).

With regard to the provision of liquidity, Designated Sponsors are subject to high quality criteria (minimum requirements). By way of example, when quoting Designated Sponsors must observe a maximum spread (between the buy and sell price) and a minimum quote volume (minimum lot size which must be posted on both sides of the order book). Furthermore, they are obliged to adhere to a minimum quotation duration. Due to their quotation activity, Designated Sponsors are in principle also subject to the applicable rules for Regulated Market Makers under MiFID II / MiFIR.

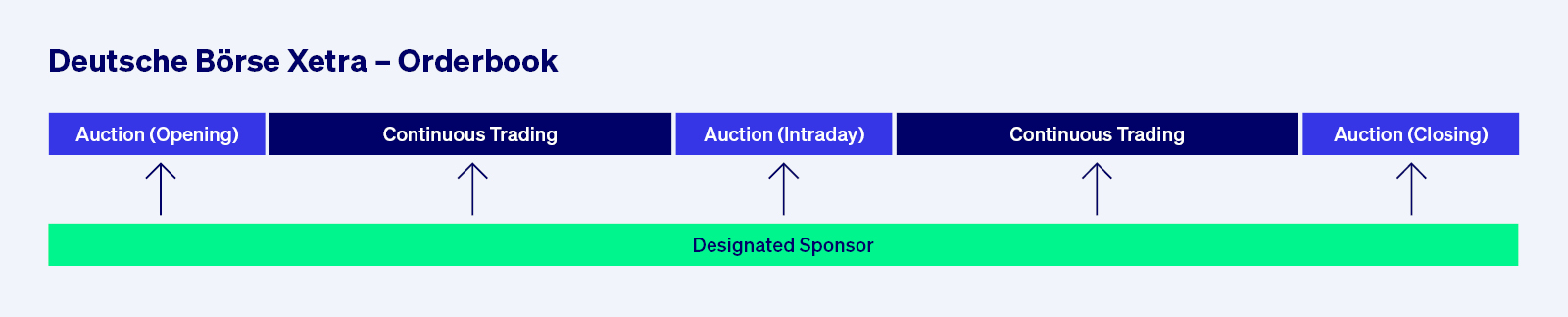

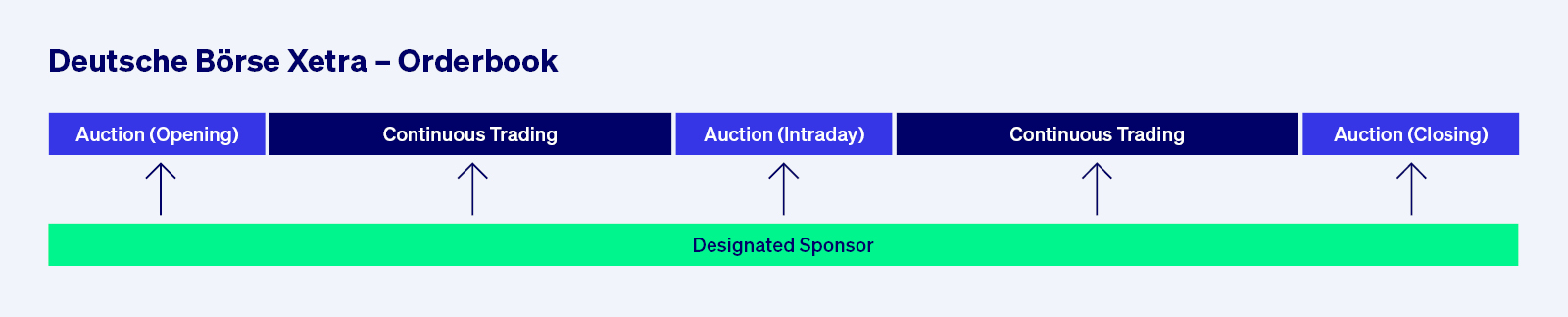

By the support of Designated Sponsors, continuous trading on Xetra is available for less liquid securities:

Trading time: 9:00 a.m.-5:30 p.m.

Tradable instruments: Equities, ETFs and ETPs

Cash Market Business Development

designated-sponsoring@deutsche-boerse.comMarket Status XETR ⓘ

XETR

The market status window is an indication regarding the current technical availability of the trading system. It indicates whether news board messages regarding current technical issues of the trading system have been published or will be published shortly.

Please find further information about incident handling in the Emergency Playbook published on the webpage under Data & Tech > Information Channels > Emergency procedures. Detailed information about incident communication, market re-opening procedures and best practices for order and trade reconciliation can be found in the chapters 4.2, 4.3 and 4.5, respectively. Concrete information for the respective incident will be published during the incident via newsboard message

We strongly recommend not to take any decisions based on the indications in the market status window but to always check the production news board for comprehensive information on an incident.

An instant update of the Market Status requires an enabled up-to date Java™ version within the browser.